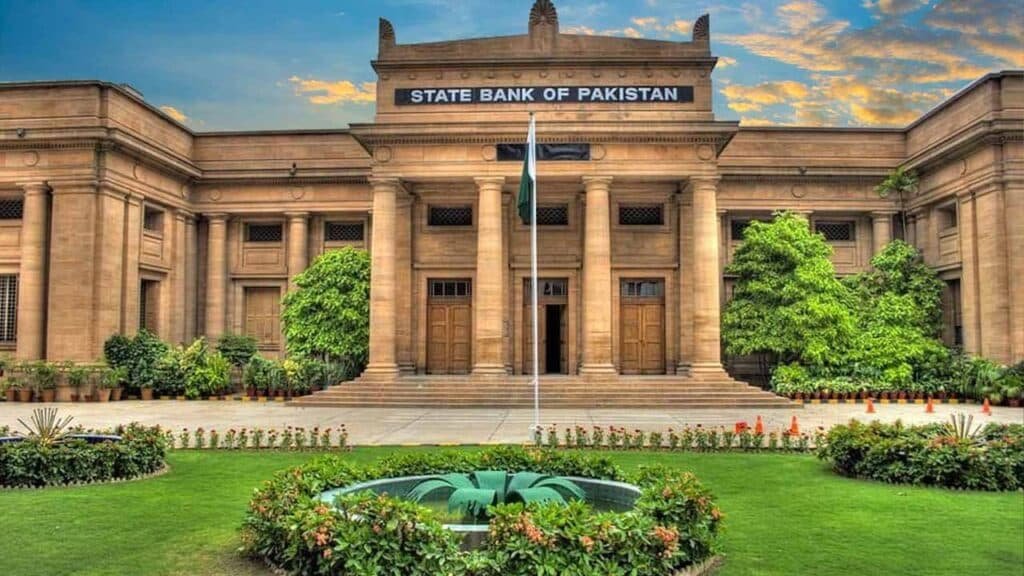

Pakistan recorded a marginal Current Account Deficit (CAD) of just $12 million in February 2025, while maintaining an overall surplus for the fiscal year, highlighting the country’s improved external position, according to the latest data from the State Bank of Pakistan (SBP).

In the first eight months of FY25 (July-February), Pakistan’s Current Account Balance remained in surplus at $691 million, a remarkable turnaround from the $1.7 billion deficit recorded in the same period last year. This surplus reflects stronger foreign exchange inflows, controlled outflows, and effective economic policies.

The latest trade figures indicate a healthy economic outlook, with both exports and imports growing, reflecting higher industrial activity and increased participation in international trade. Goods exports surged by 7.2 per cent year-on-year in 8MFY25, while imports rose by 11.3 per cent. Similarly, services exports grew by 6.0 per cent, and services imports increased by 12 per cent. Overall, total trade (goods and services combined) showed a positive trend, with exports expanding by 6.9 per cent and imports rising by 11.4 per cent.

The increase in both exports and imports suggests rising global demand for Pakistani goods and services, as well as growing domestic economic activity. The higher import figures, particularly in capital and industrial goods, indicate greater investment in productive sectors, which can drive long-term economic growth. While a widening trade deficit due to rising imports requires careful monitoring, the overall external position remains stable.

The continued surplus in the Current Account highlights Pakistan’s improved foreign exchange management, higher remittance inflows, and stronger trade performance. Experts believe that sustaining this positive trend will depend on further export growth, strategic import management, and maintaining investor confidence. With the government’s ongoing initiatives to boost exports and attract foreign investment, Pakistan is on a path towards greater economic stability in FY25.