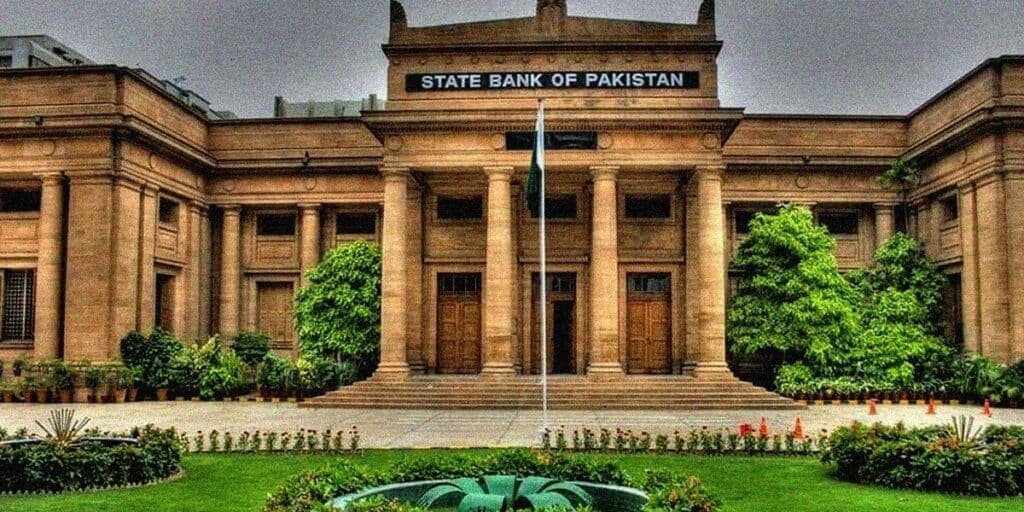

WEBDESK: The State Bank of Pakistan has issued Raast participation criteria outlining the minimum requirements for the entities who want to become Raast participants.

Raast is a state-of-the-art instant payment system launched by the State Bank of Pakistan (SBP) in 2021 to facilitate instant, safe and efficient transfer of funds across the country.

Raast offers a bulk payment facility, person-to-person (P2P) transfers, person-to-merchant (P2M) payments, and payment initiation services.

While there has been a significant increase in digital payments in Pakistan over the past five years, cash transactions still contribute a considerable portion of the overall payment system.

Trying to fast-track the payment system and increase digital payments, the SBP has issued Raast participation criteria outlining minimum requirements for the entities wanting to become Raast participants and having the necessary functional and technical capabilities to facilitate their customers through Raast.

Since its launch, 44 entities including SBP Regulated and Government entities have joined Raast as the participants. SBP believes that the issuance of Raast participation criteria will facilitate onboarding of clients, promote digital payments and stimulate innovation and competition in the market.

Raast participation can be terminated or voided by the State Bank for any entity with immediate effect if it is in the public interest or if one of the participants void any rules, laws etc.

The central bank may get involved if any entity threatens Raast’s security or reputation or if they fail to adhere to the rules and obligations that have been set forth for them.

Read more: New UAE visa rules: online submissions, fee updates, biometric checks