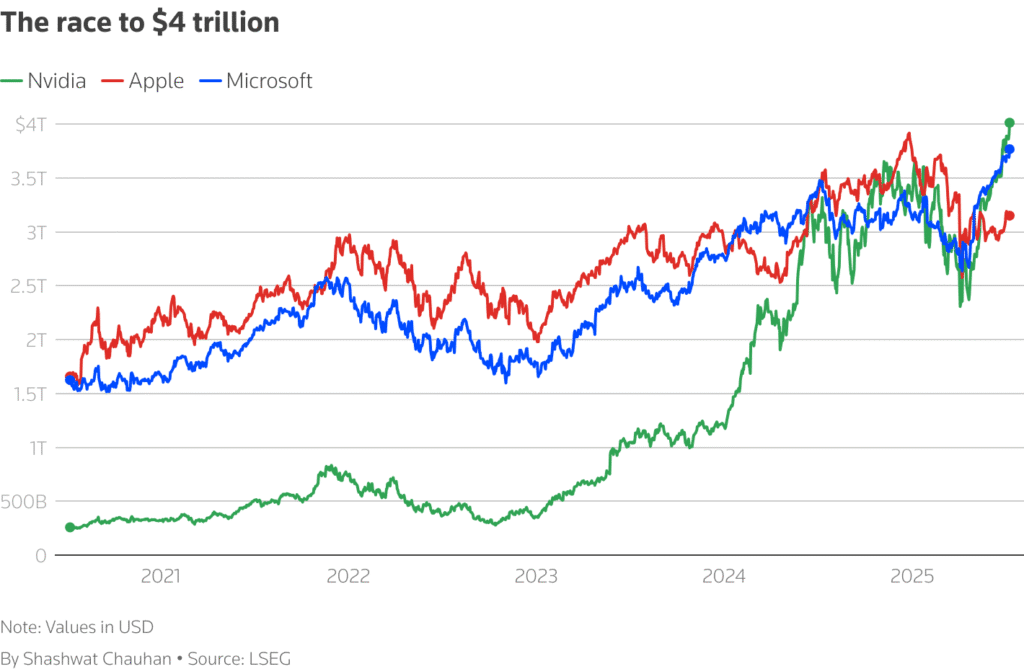

WEBDESK: Nvidia has achieved a historic milestone by becoming the first publicly listed company to briefly cross a $4 trillion market value. The California based chipmaker’s shares rose as much as 2.76per cent in early trading on Wednesday, reaching an intraday record of $164.42, before closing up by 1.8per cent.

This left Nvidia’s market value just shy of $4 trillion at the end of the day, at $3.97 trillion.

This significant achievement places Nvidia ahead of long standing tech leaders Apple and Microsoft, both of which have been competing for the title of the world’s most valuable company.

Nvidia: From $1 Trillion to $4 Trillion in Just Over a Year

Nvidia first crossed the $1 trillion market value mark in June 2023. In a remarkable display of growth, it tripled that figure within just over a year a feat unmatched by Apple and Microsoft, the only other US companies with market values above $3 trillion.

The company’s incredible surge is largely driven by the global artificial intelligence (AI) boom. The data centres and Artificial Intelligence (AI) models of huge companies like Microsoft, Amazon, and Google rely on Nvidia advanced chips. Market analysts expect worldwide expenditure on AI infrastructure to surpass the figure of $200 billion by 2028, which means that Nvidia will maintain good long-term demand of its technologies.

A Rocky Start to 2025 And a Rapid Rebound

Although the company has achieved success recently, it has had to encounter several challenges early this year. A low cost but strong artificially intelligent model developed by a Chinese startup called Deepseek sparked fears over the nature of future high priced AI chip and as such made Nvidia stock to crash as much as 37per cent over the period between January and April 2025.

Further adding to its difficulties were renewed trade tensions between the United States and China under President Donald Trump. Nvidia reported missing out on $2.5 billion in potential revenue during the fiscal quarter ending April due to US export restrictions on its H20 AI chips to China.

However, the company quickly bounced back. Optimism surrounding trade deals between Washington and its trading partners, along with continued investor confidence in AI’s long-term potential, lifted Nvidia’s stock by 74per cent from its April lows.

Record Breaking Financial Results

In the quarter ending April, Nvidia reported revenue of $44.1 billion a staggering 69per cent increase compared to the same period the previous year. The company expects second-quarter revenue to come in at around $45 billion, with official results due to be announced on 27 August.

Nvidia’s stock performance has been equally impressive. Including recent gains, the company’s share price has surged around 22per cent in 2025 alone, outperforming the Philadelphia Semiconductor Index, which rose nearly 15 per cent in the same period.

Nvidia: Dominating the Market and Global Indexes

Nvidia’s growing market value now represents 7.3 per cent of the S&P 500 index, outpacing Apple’s 7per cent and Microsoft’s 6 per cent weightings. According to LSEG data, Nvidia is currently worth more than the combined value of the entire stock markets of Canada and Mexico. Remarkably, it also exceeds the total value of all publicly listed companies in the United Kingdom.

Its stock is currently trading at a 12 month forward price-to-earnings ratio of 32, slightly below its three year average of 37 a figure analysts see as reasonable given its dominant role in the AI sector.

The leader in AI solutions, Nvidia, faces competitors like Advanced Micro Devices (AMD), trying to occupy part of the market with cheaper processors. Meanwhile, big AI users like Amazon, Microsoft, and Alphabet (a parent organization of Google) have been under pressure by investors to get their sky-high AI expenditures under control.

Nonetheless, Nvidia is one of the most innovative companies. It unveiled a new iteration of its Blackwell chip in March, named the Blackwell Ultra, which was intended to more fully serve the higher needs of AI models with more advanced capabilities of reasoning. The company is investing in AI enabled autonomous robots and vehicles too.

Nvidia’s CEO Jensen Huang’s

Jensen Huang is the co-founder and CEO of Nvidia who is credited to have contributed to its success. Huang is a powerful figure in the world of tech, and he has recently given the keynote speech in Computex 2025, Taipei. He has already acquired political prominence, accompanying US president Trump on a trip to Saudi Arabia in May, and collaborating in Project Stargate, a 500 billion dollar AI infrastructure initiative to enhance American capabilities in the field of technology.

As of July 2025, Bloomberg’s Billionaires Index ranks Huang as the world’s 10th richest person, with a personal net worth of $140 billion.

On a recent earnings call, Huang expressed confidence in AI’s future, predicting it would become essential to every country and industry. “AI is this incredible technology that’s going to transform every industry, from software to healthcare, financial services to retail, and manufacturing to transportation,” he remarked.

Wall Street Predicts Nvidia’s Continued Ascent

Financial analysts remain optimistic about Nvidia’s future. Investment firm Loop Capital recently estimated the company’s market value could climb to $6 trillion by 2028. “While it may seem incredible that Nvidia’s fundamentals can continue to rise from current levels, the company remains essentially a monopoly in critical AI technology,” analysts Ananda Baruah and Alek Valero wrote in a June research note.

For now, Nvidia stands as the clear leader in the AI revolution with its chips powering the technology at the heart of what is expected to be one of the defining industries of the next decade.

Read more: Apple loses senior AI engineer to Meta as AI challenges mount